Should we expect a breakout or a rebound on FTSE China A50 Index?

FTSE China A50 Index is heading towards the support line of a Falling Wedge. If this movement continues, the price of FTSE China A50 Index could test 11489.0372 within the next 16 hours. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding just like […]

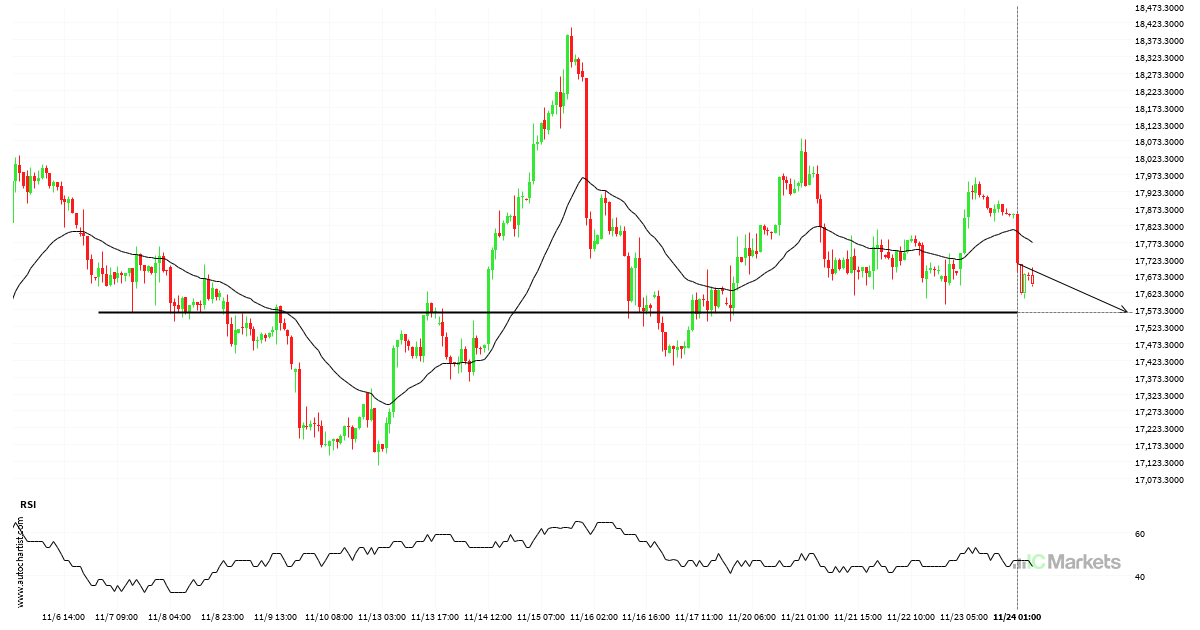

What’s going on with Australia 200 Index?

Australia 200 Index dropped sharply for 21 hours – which is an excessively big movement for this instrument; exceeding the 98% of past price moves. Even if this move is a sign of a new trend in Australia 200 Index there is a chance that we will witness a correction, no matter how brief.

FTSE China A50 Index – getting close to resistance of a Channel Down

Emerging Channel Down detected on FTSE China A50 Index – the pattern is an emerging one and has not yet broken through support, but the price is expected to move up over the next few hours. The price at the time the pattern was found was 11785.49 and it is expected to move to 11974.4925.

Should we expect a breakout or a rebound on Hong Kong 50 Index?

Hong Kong 50 Index is trapped in a Descending Triangle formation, implying that a breakout is Imminent. This is a great trade-setup for both trend and swing traders. It is now approaching a resistance line that has been tested in the past. Divergence opportunists may be very optimistic about a possible breakout and this may […]

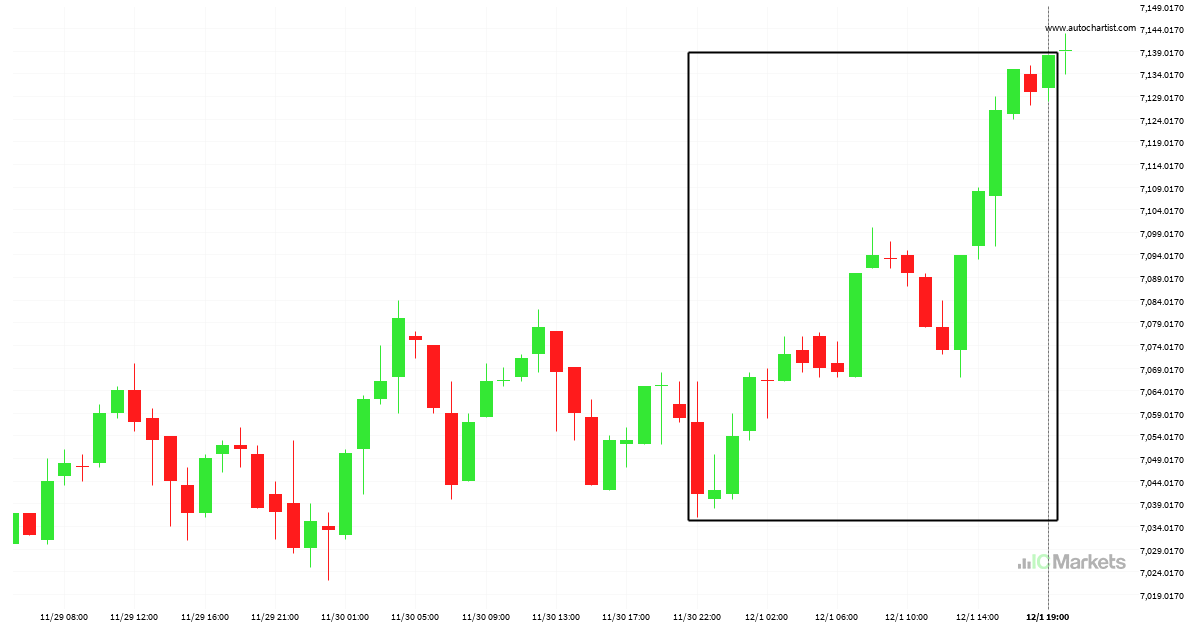

Australia 200 Index approaching resistance of a Rising Wedge

Australia 200 Index is heading towards the resistance line of a Rising Wedge. If this movement continues, the price of Australia 200 Index could test 7077.6759 within the next 11 hours. It has tested this line numerous times in the past, so this movement could be short-lived and end up rebounding just like it did […]

Australia 200 Index approaches important level of 7065.5498

Australia 200 Index is moving towards a resistance line. Because we have seen it retrace from this level in the past, we could see either a break through this line, or a rebound back to current levels. It has touched this line numerous times in the last 13 days and may test it again within […]

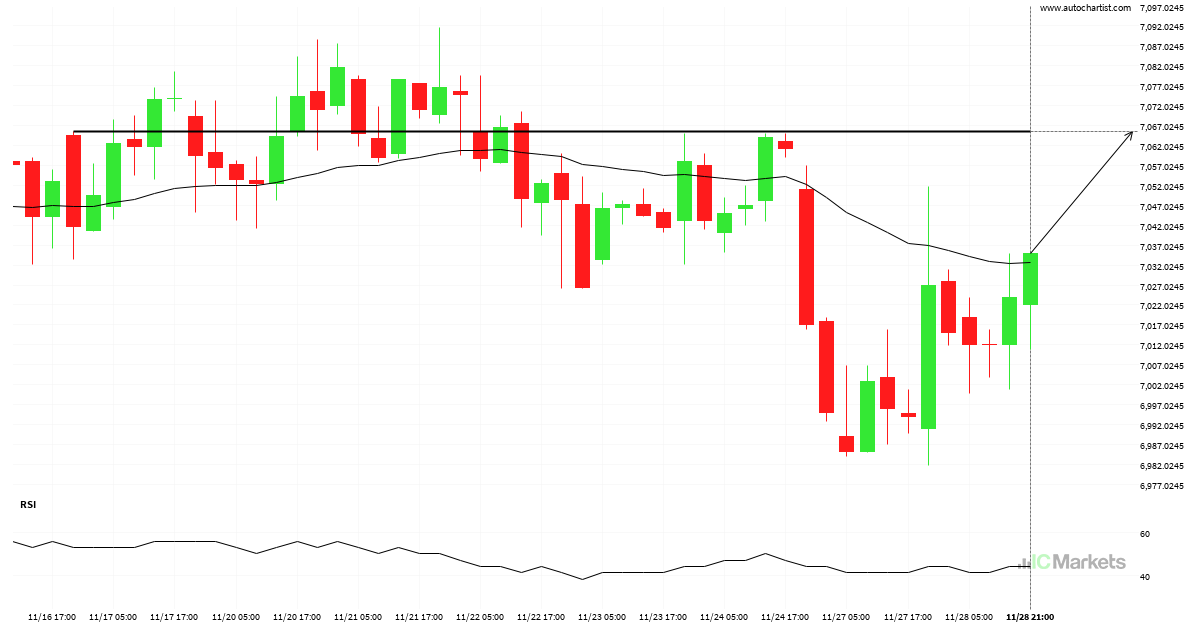

Important price line breached by Hong Kong 50 Index

The breakout of Hong Kong 50 Index through the 17566.2500 price line is a breach of an important psychological price that is has tested numerous in the past. If this breakout persists, Hong Kong 50 Index could test 17127.4746 within the next 3 days. One should always be cautious before placing a trade, wait for […]

FTSE China A50 Index approaching important bearish key level

FTSE China A50 Index is moving towards a key support level at 11845.6104. This is a previously tested level for FTSE China A50 Index. This could be a good trading opportunity, either at the spot price, or after breaching this level.

Hong Kong 50 Index approaches important level of 17566.2500

Hong Kong 50 Index is en route to a very important line that will be a definite deciding factor of what is to come! We may see this trajectory continue to touch and break through 17566.2500, unless it runs out of momentum and pulls back to current levels.

Either a rebound or a breakout imminent on Hong Kong 50 Index

Hong Kong 50 Index is moving towards a resistance line which it has tested numerous times in the past. We have seen it retrace from this line before, so at this stage it isn’t clear whether it will breach this line or rebound as it did before. If Hong Kong 50 Index continues in its […]